So Merrill Lynch, where I toiled for 12 years, faces the end of nearly a century as a private company. At least it’s not like Lehman, an even-older company that was forced into bankruptcy when nobody would assume its liabilities.

One of my earliest memories of working at Merrill Lynch is hearing CEO William A. Schreyer say “we plan to remain fiercely independent.” This was in 1988, a year after the 1987 crash, a time when venerable Wall Street names like Shearson and E.F. Hutton were disappearing into larger firms. “Good,” I thought at the time. “The boss doesn’t plan to sell.” I did not yet realize that it’s not that simple at a large public company.

There were takeover rumors throughout the time I was there — Chase was the most often rumored suitor. Chase eventually bought JP Morgan instead.

By the time I left in 2000, I had a chunk of Merrill Lynch stock in my company retirement account. I was a corporate gumby, not a Master of the Universe, so it was a modest chunk by Wall Street standards, but still by far the biggest component of my financial holdings. After I left, I could have rolled the stock over into an IRA and sold it, or part of it, at any time… but I did not. Whenever I thought about it, the stock was down, and I waited for better times. When better times arrived, I didn’t think about it — I was no longer on Wall Street, and was not so focused on the ups and downs.

Courtesy of Yahoo Finance, here is the chart of MER’s stock price since I left the company and first became eligible to sell my shares:

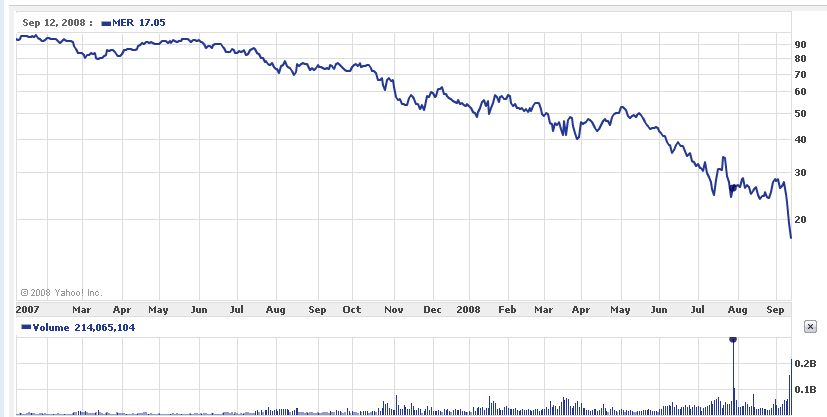

And, since that doesn’t quite capture the total flavor of What Might Have Been, here is the the chart since January 2007, when a New Year’s resolution I did not make would have allowed me to sell the stock in the mid-90s:

And, since that doesn’t quite capture the total flavor of What Might Have Been, here is the the chart since January 2007, when a New Year’s resolution I did not make would have allowed me to sell the stock in the mid-90s:

I wasn’t paying attention Friday, when MER dropped to $17.05. I couldn’t have rolled it over fast enough to sell in a panic, anyway. Now comes Bank of America offering $29 a share in a stock-for-stock transaction, which means that like all of the folks I still know at Merrill, I’m hoping BAC doesn’t crater when the market opens in about 60 minutes.

I wasn’t paying attention Friday, when MER dropped to $17.05. I couldn’t have rolled it over fast enough to sell in a panic, anyway. Now comes Bank of America offering $29 a share in a stock-for-stock transaction, which means that like all of the folks I still know at Merrill, I’m hoping BAC doesn’t crater when the market opens in about 60 minutes.

Looking back, I can see I never sold because I didn’t really want to — I’m fond of the company and proud to have worked there, despite the Enron scandal and the analyst scandal and the sub-prime debacle. All of those happened after I left — while I was there, we (justifiably) boasted about a Tradition of Trust that largely kept the mud off of our corporate feet. (No, I don’t think Gumby Man was the reason the company stayed on the straight and narrow — I just had the good fortune to be there during relatively good times.)

Sentiment is a bad reason to hold a stock, of course, and I have no such attachment to BAC. Time to look into that rollover. Not that I’ll liquidate right away, but I need to be ready to diversify.

Sentiment is a bad reason to hold a stock, of course, and I have no such attachment to BAC. Time to look into that rollover. Not that I’ll liquidate right away, but I need to be ready to diversify.